This post may contain affiliate links.

If you haven't figured it out by now, I'm big on saving money, but I have to save up front and automatically. I can't save at the end because my reality is that I will spend what is available to me (which is why I have a budget).

The reason why I am big on saving is because I have been in a few positions where I needed money for an unexpected expense and I did not have the money so I had to either scramble to get the money or I had to borrow the money. One of the moments that stick out the most is my senior year of college when I was about to graduate and my unemployment ran out. The only income I had was graduation money for about 6 weeks and that didn't cover my expenses. I have mentioned in previous blog posts that I save in multiple ways for different reasons and one of the ways I save is by using Digit.

What is Digit?

Digit is an app available in the Apple App Store and the Google Play Store, that provides a FDIC insured online savings account.

About a month ago, Digit announced that they are going to start charging $2.99 a month for their services. I will give you my thoughts on the fee at the end.

“I’m a big fan of saving money but have to save upfront and automatically”

How it works!

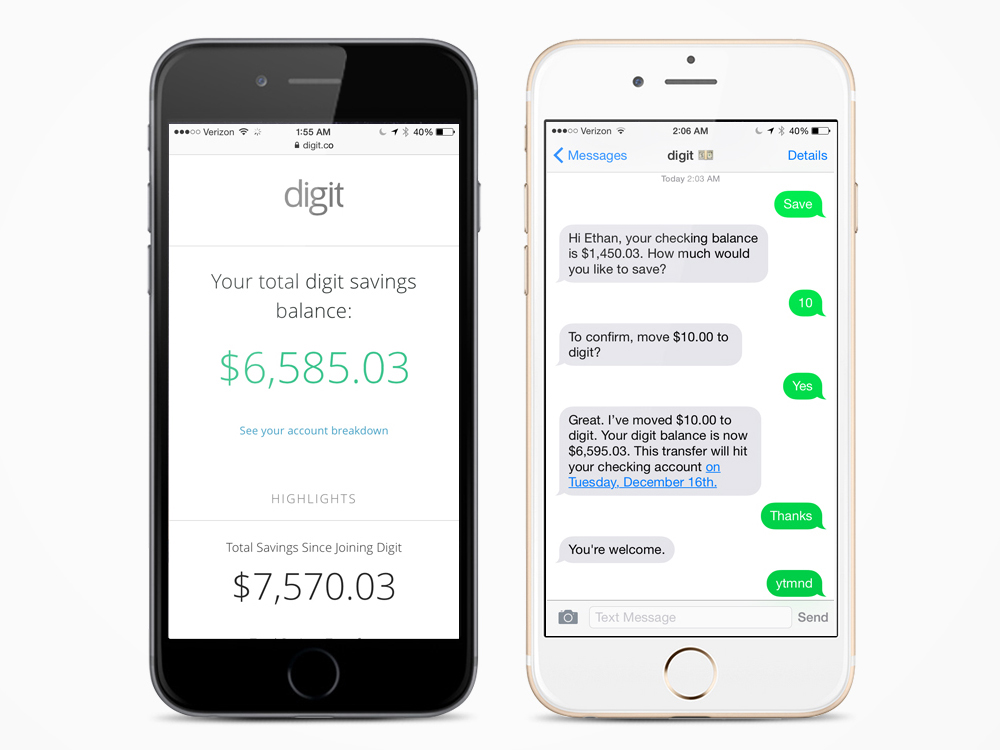

After connecting your checking account to Digit, it monitors your income and spending patterns on daily basis, looking for opportunities to save money.

They are determined to not overdraw your account but if they accidentally overdraw your account they will pay your insufficient funds fees up to 2 times per customer.

Once Digit starts saving money, you will start to receive fun text notifications with your checking account balance as of that day and how much you had the day before and if you reply "Recent" they will provide you with a list of latest transactions. You have the option to change your notifications from daily to weekly or not at all.

Withdrawals can be easily processed by text or in the app and you will receive the funds by the next business day.

If things are tight at the moment and you need to stop saving temporarily, you can stop saving at any time by texting “pause” to Digit.

Digit has several commands you can text to help manage your account. Which makes it easy to manage your account on the go. A few of the commands are:

Savings - Provides you with your savings balance

Checking - View your checking balance

Pause - Stop saving until you want to start again

Save - Add money to your Digit account

Withdraw - Withdraw money from your digit account

Click here for the full list of commands.

Goalmojis

Digit has recently announced Goalmojis which allows you to connect your savings to your specific savings goals. Digit will automatically decide when it is safe to move money toward your goal or you can tell it to save money toward your goal. You can create a new goal in the app or by text message.

How I use it?

As I mentioned in previous posts, I have multiple bank accounts, so in order to make Digit work effectively for me, I connected it to my fun money account.

I spend my fun money however I want, so that is usually the card I'm swiping. My Digit account is not my emergency fund and I'm not saving for a specific purpose, it's just one of my random savings accounts. Lately, I have been calling it the Sweet 16 gift fund. My kid has been going to Sweet 16 parties for the last 2 years, so for the last year, all gift money came from digit because I refuse to add a Sweet 16 gifts line to my budget.

As long as my kid doesn't get invited to a Sweet 16, I don't touch the money because I really don't like to take money out of my savings but Digit has really help me keep my sanity. Instead of pulling money out of my regular savings account, emergency fund, or checking account, I withdraw it from Digit. So it's my lifesaver.

What I can't live without

I really like the fact that Digit saves for me automatically. In order for me to effectively save, I have to do it before anything else. So all of my savings is done automatically before I pay my bills. Digit gives me an additional opportunity to save during the week.

The text messages will normally alert you daily but I changed mine to weekly for my sanity. Even though I am big on checking my account balances daily, I skip my fun account on Monday becauseDigit will tell me at noon.

Simple process. I have a password for the website but if I forget it, I can still access my account by text message. There is also an app, which I really do not use because I like the text feature.

What I could do without

Only one account connected at a time. When I switched banks I wanted to add the new account first and then delete the old one but Digit does not have the capability to have two accounts connected at one time. So, I had to withdraw my money from the Digit account, wait for it to clear my bank, delete my old account from Digit and then send the money back to Digit. It was too much work and I lost the opportunity to save during that time.

Also, do not choose aggressive savings, there a few people who have had most of their money pulled into savings because it's uh aggressive.

Interest. Since Digit is not a bank, it does not pay interest but it does pay savings bonuses (1% annually).

Who it's for?

Digit is for you if you love to bank online, you use mobile banking and you don't like walking into the bank to conduct business.

If you understand that FDIC Insurance covers up to $250,000 and it's the same insurance your brick and mortar bank uses to protect your cash.

If you are new to saving and you want to start saving without thinking about it.

If you are already saving but you're looking for another way to save.

Who it's not for?

If you're scared of doing business online, it's not for you.

If you save your money under your mattress, because you are scared of banks, this is not for you.

If you are scared or you are worried about everything, save yourself the stress.

If you do not have enough money to save on a regular basis, it's not for you because the new $2.99 per month fee will reduce the amount you are able to save and Digit may save the money needed to pay your expenses.

My thoughts on the $2.99/month fee

Digit is free for 100 days and then they will start charging $2.99/mo. I really like DIGIT's features and the ability to save money without thinking about it is great but I'm not a fan of the new fee they are implementing from the customer standpoint but I do understand from the business standpoint. I think the effects of the fee depends on how much you will be able to save each month. If you are only saving $20 or less a month ($240 a year) then it might not be worth the $2.99 ($36 a year) monthly fee. Now if you're able to save $1000 a year then $36 a year maybe worth it, but...if you struggle to save money period the ease of saving with Digit may be worth every penny of the fee.

I have been testing out another automatic savings app for the last 3 months, which I will review next.

Like the idea of saving automatically using Digit, you can sign up here.